MoneyMan - Займы онлайн

Description of MoneyMan - Займы онлайн

Moneyman - Online loans is an application that allows citizens of the Russian Federation who have reached the age of majority to take out loans. The application is provided by the Limited Liability Company Microfinance Company "Money Men". The Company is a microfinance organization and is included in the state register of microfinance organizations: https://www.cbr.ru/microfinance/registry since October 25, 2011 under number 2110177000478. The activities of the Company are controlled by the Central Bank of the Russian Federation and are regulated by:

- Federal Law of July 2, 2010 N 151-FZ “On microfinance activities and microfinance organizations”;

- Federal Law of December 21, 2013 N 353-FZ “On consumer credit (loan)”.

The Moneyman - Online Loans application allows you to:

- receive a loan in the amount of 1,500 rubles to 100,000 rubles with a repayment period from 10 weeks to 18 weeks;

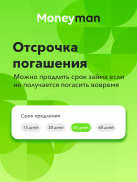

- manage the loan (find out the status, repay the loan and extend the loan term);

- receive and spend bonus points.

The minimum annual interest rate on the loan is 0 percent per annum, and the maximum annual interest rate on the loan is 36 percent per annum. The maximum annual interest rate corresponds to the value established by the Central Bank of the Russian Federation.

The cost of the loan is calculated as follows:

cost of loan = loan amount + amount of interest (amount of interest = number of days of use of the loan multiplied by the interest rate per day (interest rate per day = annual interest rate divided by 365 days).

Example of calculating the total cost of a loan:

Issued: 50,000 rubles.

The repayment period is in 70 days.

The annual interest rate is 36 percent per annum.

Interest rate per day: 36 percent per annum / 365 days = 0.098 percent per day.

The amount of interest accrued on the loan per day in rubles: 50,000 rubles * 0.098 percent per day = 49 rubles.

The amount of accrued interest for the period of use of the loan: 49 rubles * 70 days = 3430 rubles.

The total cost of the loan in rubles (loan amount + interest amount): 50,000 rubles + 3,430 rubles = 53,430 rubles.

When processing personal data, the Company is guided by:

- Federal Law of December 27, 2006 N 152-FZ “On Personal Data”;

- Company Privacy Policy: https://moneyman.ru/about/docs/mobile-privacy-policy/

- Policy for the processing and protection of personal data of the Company: https://moneyman.ru/about/docs/policy-personal-data-3/

In accordance with the Company's Privacy Policy, the purposes of collecting personal data are:

- consideration of the possibility of concluding a loan agreement;

- obtaining information about the borrower’s credit history;

- providing the opportunity to interact with the application, collecting statistics on application visitors to improve the quality of the application and its content, conducting statistical studies and reviews, promoting goods and services supplied by the Company;

- other purposes specified in the Privacy Policy.

The Company carries out the following actions with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (provision, access), blocking, deletion, destruction of personal data.

We also note that the Company is in the register of personal data operators: https://pd.rkn.gov.ru/operators-registry/operators-list/?id=77-18-009538 and is controlled by the Federal Service for Supervision of Communications, information technologies and mass communications of the Russian Federation.

The Moneyman - Online Loans application does not have access to confidential information, including photos and contacts.